Q4 2019 Commentary

Executive Summary

- During 2019 our strategies delivered strong returns by focusing on what we do best – active management of corporate bond portfolios combined with focused risk management.

- Globally there is a great deal of political and economic uncertainty, and as such there are very different opinions around what 2020 will bring.

- In a more uncertain and volatile environment, we believe investment managers will need to be highly selective and opportunistic to take advantage of opportunities as they present themselves.

- Given our flexible and highly active approach to investing, we are excited about the opportunities for the coming year – and we welcome the opportunity to differentiate ourselves from more traditional managers.

Our active approach to investing in corporate bonds delivered strong risk-adjusted returns this year. 2019 was a year where our strategies delivered on our dual mandate of providing strong returns while also actively and effectively managing

risk. We were able to add considerable value for our investors by finding attractive investment opportunities across global credit markets while maintaining a prudent risk profile. This enabled us to preserve capital during the periods of stress we

saw throughout the year.

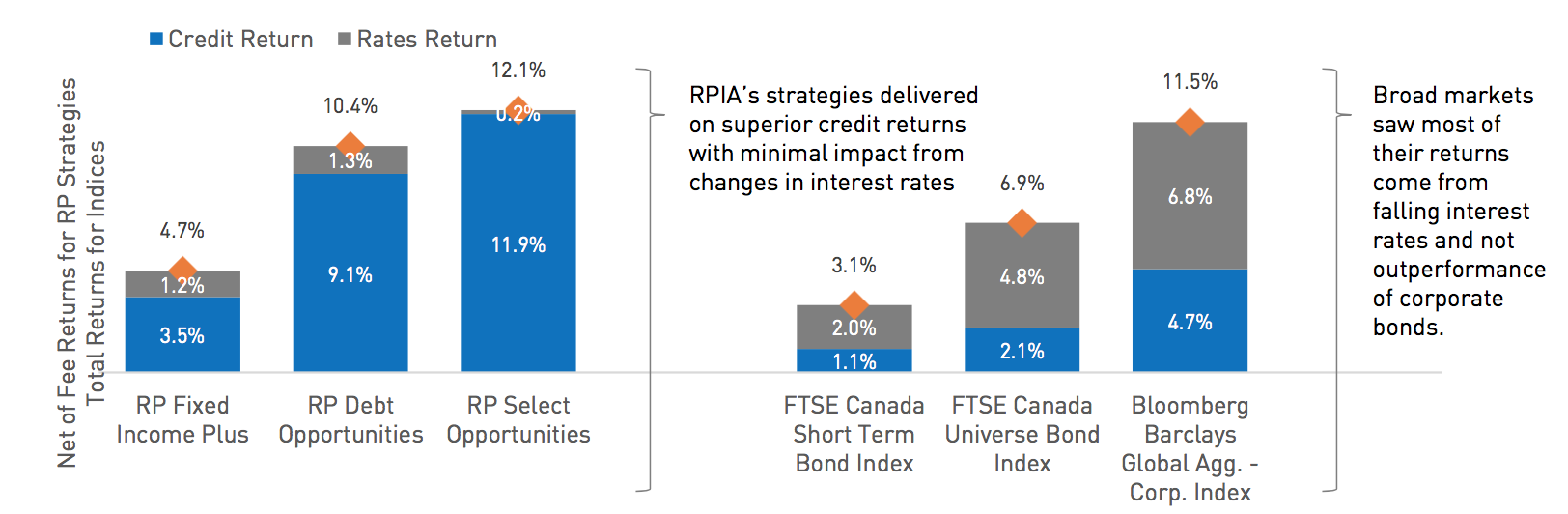

The majority of our returns came from finding value in corporate bonds and not from taking interest rate risk. Most of the returns this year for traditional bond managers were generated by falling interest rates following the Federal

Reserve’s decision to cut rates. We would argue this is a “low-quality” return. The reason for this is predicting the direction of interest rates is hard to do consistently – and so money made today can easily be lost tomorrow.

For this reason, we tend to be very cautious when it comes to taking interest rate risk in our portfolios. Instead, we prefer to focus our efforts on taking credit risk. A key reason for this is that the corporate bond market is highly inefficient.

We have an approach to that market whereby we have been able to consistently extract value in a repeatable fashion. Thus, the composition of 2019’s returns are in line with what we hope to produce year-in and year-out – true added value

from expertise in selecting and trading corporate bonds.

RPIA Strategies Return Profile Focused on Our Areas of Expertise - Corporate Bond Investing

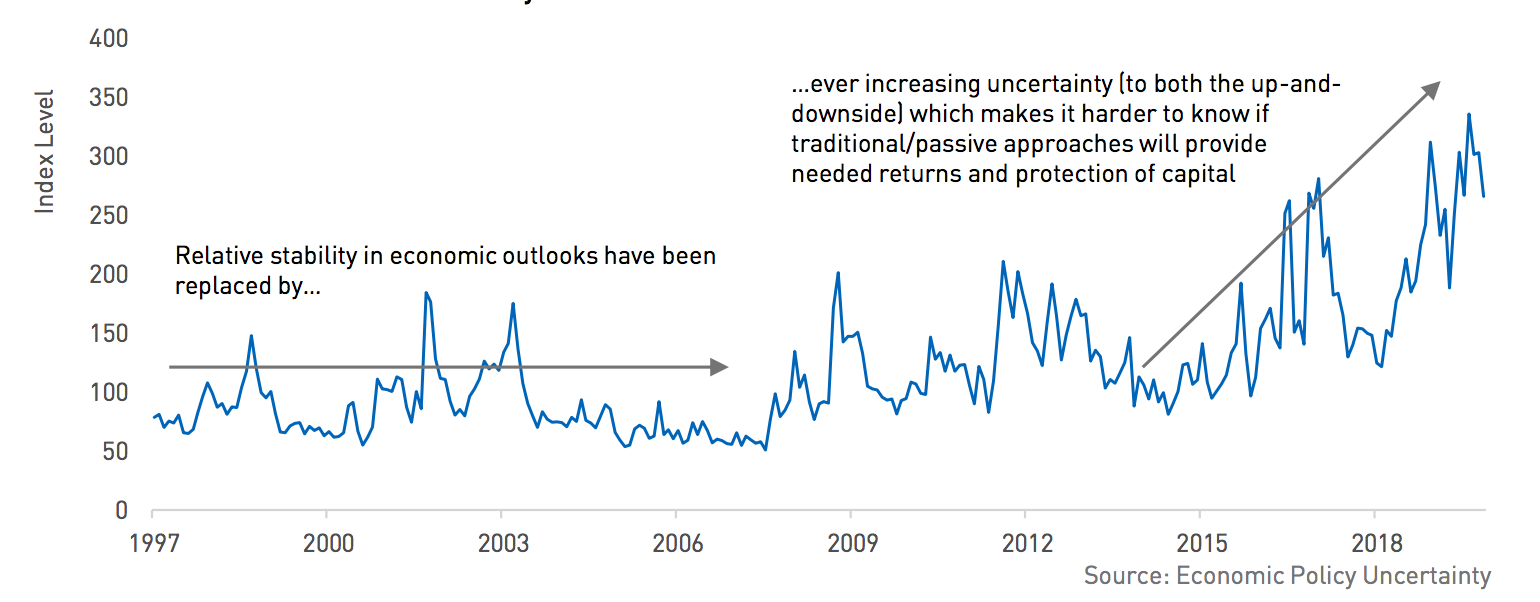

A key theme in the markets today is the prevalence of elevated uncertainty. These unknowns can be found across many areas that impact financial markets. One of the most important is the uncertainty surrounding when we will see the end

of the current economic expansion. Consider that this is the longest period of expansion we have seen since the great depression. Another key unknown arises when we look at central bank positioning that does not seem to reflect the current economic

backdrop. U.S. unemployment is at 3.6% and trending lower, and yet the Federal Reserve is once again loosening rather than tightening policy. In Canada, monetary policy sits on hold as Governor Poloz weighs policy normalization against the possible

negative impacts to a highly indebted Canadian consumer. But what will the long-term implications of such extreme policy stances be? How disruptive will it be when central banks finally decide to “normalize” policy? When stuck between

extremes, the effects of uncertainty can be much more acute.

Economic Uncertainty Sits at Elevated Levels Which Should Continue Into 2020

It’s critical at this stage in the cycle to being highly selective when it comes to taking credit risk. Over the last ten years, supportive central bank policy has been a windfall for risk assets of all types. When one looks at

the behavior of corporations over this period it’s clear that on average leverage has increased and management teams have favored shareholders over bondholders. We have written elsewhere about the opportunity we see in BBB rated credit, where

certain management teams have bucked this trend and started acting conservatively and putting the interests of bondholders first. We continue to see attractive value in certain BBB rated securities particularly in a low interest rate environment.

Aside from this, commentators in the financial press often suggest avoiding corporate bonds given this additional risk. We beg to differ – we believe that investors just need to think about moving away from a passive approach to the asset class

and partnering with an active and opportunistic manager.

We believe uncertainty and volatility will present us with the opportunity to clearly differentiate ourselves from passive managers. Uncertainty means a broader range of possible outcomes. We don’t have a crystal ball when it comes

to seeing the future. However, we do believe that with heightened uncertainty comes greater opportunities for us to add value. We are able to actively increase risk and reduce risk quickly to reflect market dynamics, and change the composition of

our portfolios to capture opportunities as they present themselves in real time. The fact that we are able to look beyond the Canadian bond market to find value gives us a wide opportunity set – meaning we can focus very selectively on only

the best risk-adjusted opportunities. Finally, in recent years there has been strong growth in the number of passive managers in corporate bonds. These managers don’t make active investment decisions, but buy or sell based on inflows or outflows

from their clients. We find in practice this means that the market can overshoot on the upside and the downside – providing good entry or exit points for active managers focused on value. This is particularly the case during volatile periods.

Continued M&A activity will spur bond issuance and present attractive opportunities. Following the strong equity market rally in recent months - as well as the reduction in concern about near-term trade war escalation - we think many

companies will be more open to growth and M&A activity. We believe this is likely to present opportunities to pick specific sectors and companies where bonds may offer value or acquirors may need financing.

We expect to see value in securities issued by certain European banks. The European banking sector remains one area which is still undergoing some restructuring and with new ECB leadership - as well as less uncertainty around the UK election

and Brexit - it is likely that bondholder-friendly actions will continue, so we see value across the debt capital structures of certain European banking groups.

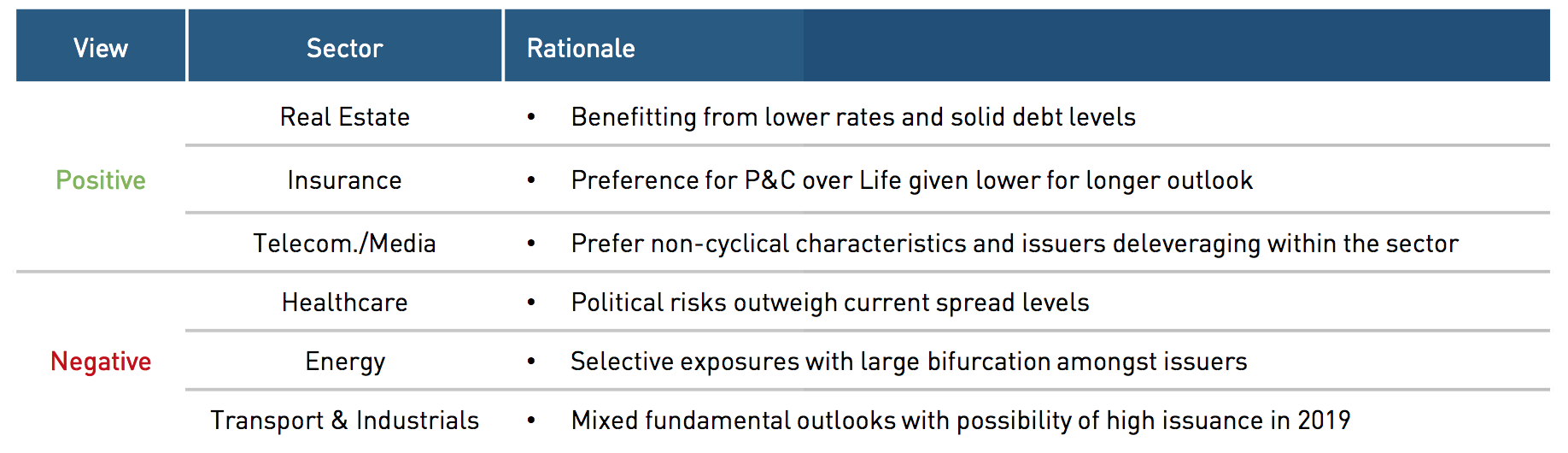

We will continue to focus on more liquid securities and tilt towards sectors where leverage is reducing. During 2020 we expect to add value through re-positioning our portfolios and reacting to developments as they occur. To enable this

we will in general focus on markets and securities where it’s easier to transact quickly and at minimal cost. This was our strategy in 2019 and we will continue to take that approach in 2020. The table below highlights some sectors that we have

positive/negative views on. However our focus is on individual companies and securities. Within Healthcare for example, there could be some volatility this year as campaigning for the US presidential election takes place. This could lead to attractive

opportunities in this sector notwithstanding our caution on the sector overall. In general we are focusing on sectors where fundamentals are stronger and where leverage is coming down rather than increasing.

During the year ahead we plan to continue to deepen our commitment to ESG. We first explicitly incorporated Environmental, Social and Governance (“ESG”) factors in our investment process in 2016 – although in reality

we had implicitly included these factors for longer. In 2018 we solidified our commitment by becoming a signatory to the UN Principles of Responsible Investing. Simply put, as stewards of your wealth we believe it is our duty to consider the broadest

range of factors when analyzing the risk of an investment. Looking at ESG factors for the companies we invest in continues to lead us to think creatively about risk and leads to engagement with management teams that can be very fruitful. One of our

“new year’s resolutions” is to deepen this commitment to ESG. To this end we have formed an ESG committee with two main commitments. Firstly, to improve the way we are embedding these factors in our investment process. Secondly,

to advance ESG through engagement with companies, peer collaboration and public action. Please don’t hesitate to reach out to us if you’d like to understand in more detail our approach in this area.

We will continue to be disciplined but flexible in our investment approach. We don’t profess to have all the answers when looking at the macroeconomic landscape. What we do have is an expertise in the area of corporate bonds and

a process that we believe will serve our investors well. This approach is to stay disciplined and focus only on those areas where our expertise lies. It means prioritizing capital preservation during challenging times. Finally, it involves being humble

and flexible – to respect the market and act quickly and decisively when market conditions change. We believe this approach is more important than ever as uncertainty increases.

We thank you once again for your support and wish you the very best for the year ahead.

Important Information