Executive Summary

- Financial markets ended the summer on a high note but are pricing volatility ahead.

- We are focused on the November election and the implications across sectors and issuers we own in the portfolios – with a focus on balancing exposures for a Trump or Biden win.

Financial markets ended the summer on a high note with most asset classes posting another month of positive returns. Corporate bond markets experienced some mixed performance as interest rates moved higher, but we have not seen material credit spread widening to date. In August, we saw an unusually high level of corporate bond issuance– with the summer usually being a slower period. While supply surges usually translate to wider credit spreads, this year’s unique issuance trends have been well absorbed by market participants as capital continues to flow into investment grade mutual funds and ETFs.

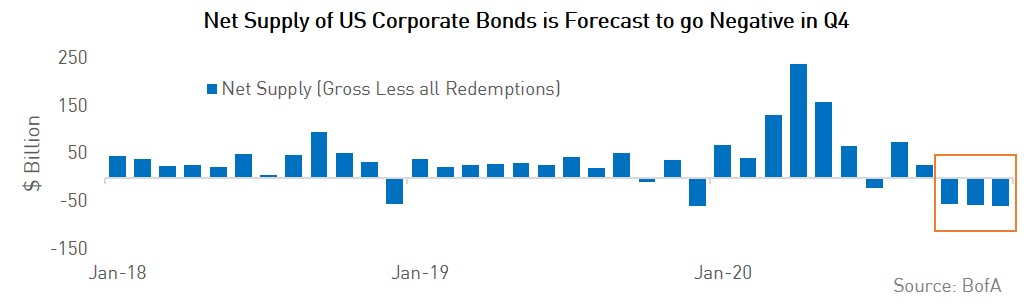

While corporate bond supply has been elevated, so has demand. Much of the new issue supply this summer was issued to refinance debt coming due. In addition, many issuers have been tendering for their debt early – in other words, buying their bonds back before maturity. This trend reflects issuers’ ability to refinance older debt at new lower rates. This lowers their borrowing costs for years to come and helps them retain more cash on the balance sheet to weather any future risks. As a result of such activity, analysts are forecasting negative net supply in the US market during Q4. This supply / demand dynamic – taken together with central banks still ready and willing to buy corporate bonds - should continue to be supportive for credit spreads. Set against this however, we must keep in mind potential COVID-19 developments, and an upcoming Presidential election in the US.

We believe the future path of COVID-19 is still a critical determinant of market sentiment. Current consensus is that there will eventually be a vaccine and that full lockdowns are unlikely to recur given the crippling economic cost. It seems that rotating restrictions and increased testing are key components of the new approach to dealing with the disease. The most COVID-sensitive sectors of the economy have most to gain from the development of an effective vaccine (airlines, hotels, restaurants, etc.) – with more defensive sectors less exposed. We continue to follow the public health trends and policy responses and are positioning our portfolios across sectors carefully.

Looking forward from here, the main catalyst for financial markets is arguably the presidential election in November. This will be unlike any past election we have seen, both because of the wide policy differences between candidates and the logistical problems around voting posed by COVID-19. Presidential elections can be difficult to forecast even in “normal” times (recall 2016) but the added complications of the pandemic have made predicting outcomes even more difficult.

Biden’s tax and fiscal policies would create clear winners and losers. Much attention has been paid to Biden’s tax policy, which could see corporate tax rates increased from 21% to 28%. While this change has significant impacts for many corporate bond issuers, we are also working our way through the less telegraphed impacts from both Biden and Trump’s policy stance. This includes Biden’s fiscal policy which will look to spend $1.3T over ten years with a focus on infrastructure and green energy/climate initiatives. Biden’s fiscal policy could create significant winners and losers in corporate bond markets. This would include benefits for issuers tied to a “rebuild America” policy and renewable energy issuers whose business models align with Biden’s carbon free America goals.

We are also analyzing the impacts from Biden’s proposed healthcare agenda. This policy proposal aims to expand the Affordable Care Act and is less concentrated on Medicare for All, a moderate stance which we think has less impact on U.S. insurers and other healthcare companies. Trade still stands front of mind as we contemplate the impact from a continued “America First” stance if Trump secures his second term versus a reversal to multi-lateral trade agreements with a Biden win. In any case, aside from who wins the presidency, who wins the Senate will be critical. The outcome of the Senate vote will have a meaningful impact on either candidate’s ability to pass legislation.

As we approach the election, we will be looking to position the portfolios to strike the right balance between risk and reward. We are focusing on sectors that are critical and well-positioned such as large systemic banks and Telecommunications. Our bias is towards companies with strong business profiles and balance sheets. We want to ensure our portfolios are positioned to take advantage of opportunities as they present themselves. The next few months will almost certainly see an increase in market volatility.

As always, we thank you for your support, and please don’t hesitate to contact the Client portfolio Management team if you have any comments or questions.