Executive Summary

- During Q3 elevated demand for corporate bonds from yield-hungry investors met record-breaking supply from corporations – and credit spreads compressed.

- Three factors are driving our current market view and positioning – the resurgence in cases of COVID-19, the upcoming U.S. presidential election and the Central Bank backstop.

- While there are a number of credit opportunities in the market, given uncertainties and overall valuation levels we remain selective in our investments.

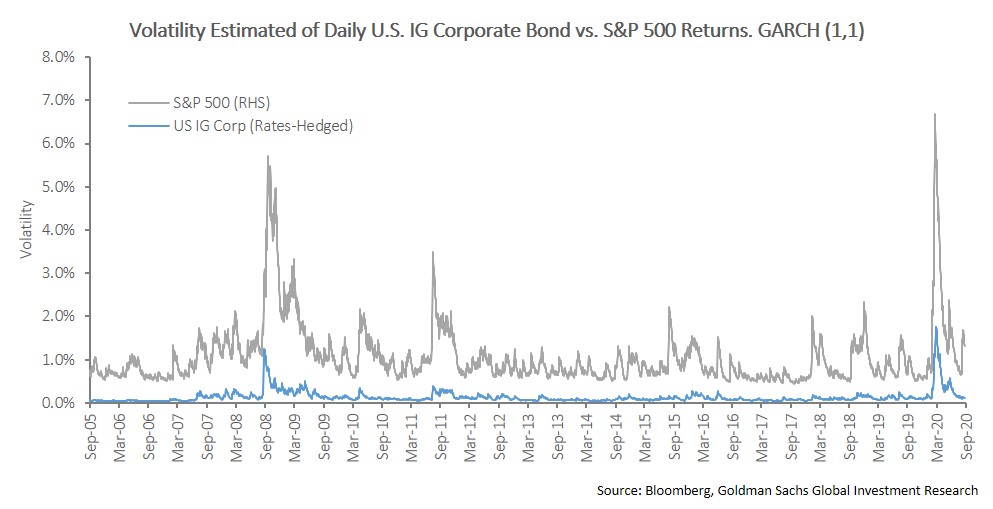

During Q3 elevated demand for corporate bonds from yield-hungry investors met record-breaking supply from corporations keen to issue debt. This resulted in elevated trading activity during a typically quiet period and a tightening of credit spreads. After a calm start to the quarter, there was some volatility in markets during September owing to a resurgence of COVID-19 cases globally and a growing belief that the U.S. presidential election in November may prove to be protracted and messy. However, while equity markets were largely impacted by the increasing volatility, with U.S. and Canadian equity market down 3.8% and 2.1% respectively1 during September, corporate bond markets held in well. It is our view that after the extreme “black swan” events of March, September has been a welcome reminder of the valuable role credit can play in dampening volatility in a well-diversified portfolio (see Appendix A for two charts illustrating this point).

Three factors are shaping our market views – the first being a resurgence of COVID-19 cases. We are seeing the return of precautionary measures in Ontario as COVID-19 cases escalate. This is particularly concerning as we are about to enter the flu season. Nevertheless, we do not anticipate another full lockdown due to the massive economic cost. Although economic activity globally is trending upwards, the recovery has been slow and uneven. We believe we are in the midst of a “K-shaped recovery” with different parts of the economy recovering at different rates and magnitudes. While some sectors – epitomized by Big Tech – are thriving, we believe others will continue to struggle and may never fully recover without support.

Secondly, we expect volatility in the coming weeks as we approach the U.S. Presidential election. The probability of a Biden victory has increased to 65% at the time of writing - although we are keenly aware of the flaws in polling techniques. Whichever candidate wins, success in getting legislation passed will depend on whether the successful candidate’s party also controls the Senate. Ultimately, we believe both candidates will want to ensure stimulus measures get passed to contain the impact of COVID-19 on the economy. We believe this is one of the reasons risk assets have been quite resilient in recent weeks.

Thirdly, the central bank backstop is supportive for credit markets, as are expected issuance trends. Although the Federal Reserve has dialed back its daily bond purchases from a high of approximately $400M to under $25M per day2, it stands on the sidelines ready to intervene if needed. In addition, although we expect to see a robust pipeline of corporate bond deals in Q4, the net issuance (taking into account bonds maturing and early redemption of debt) is expected to be negative. In other words, demand for high-quality bonds may outstrip supply as we approach the end of the year.

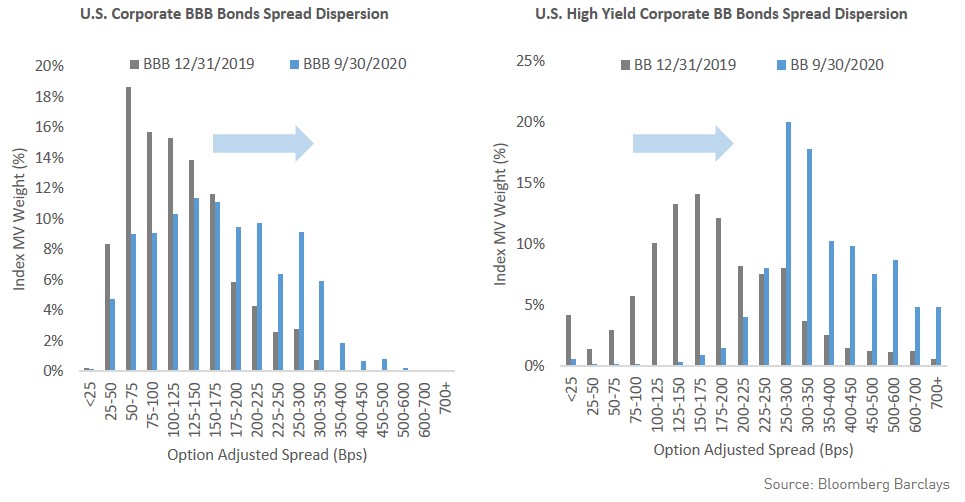

In spite of central bank policy, given uncertainties and overall valuation levels, we remain highly selective in our investments. Although credit spreads have compressed in recent months, there remains an unusually wide dispersion in credit spreads. This is visually illustrated in the charts below. We are using the flexibility we have to allocate capital based on where we see the best risk-reward.

Despite six months of credit spread compression, elevated dispersion means plenty of attractive opportunities in corporate bonds.

Fundamentally, we continue to see value in Financials and Telecoms and are being selective with cyclical exposures. We continue to like well-capitalized global banks with a focus on senior layers of the capital structure. We continue to like the defensive nature of the telecom sector although the pricing here is less attractive than in previous quarters. In some of our more return-seeking mandates, we are constructive again on a subset of aircraft leasing companies. Despite earnings pressures, the firms we are focused on have strong balance sheets and access to ample liquidity. Within this sector, we are focused on investment-grade rated issuers and securities with less than 3yrs to maturity. We are avoiding exposure to life insurance companies who face structural challenges in the form of low rates and high asset prices. We are also cautious on some of the more cyclical or COVID-sensitive sectors including Lodging, Retailers, Energy, and Media. Where we do have exposure within these sectors it is on a very selective basis in only a subset of our mandates.

In this unchartered environment, we believe investors need to think differently about their portfolios. Many investors used to rely on a portfolio of 60% equities and 40% government bonds to help them realize their long-term return objectives. In previous decades, this “balanced” portfolio could typically be relied on to provide a 5% return per annum above the rate of inflation. Looking forward, we think it is highly doubtful this 60/40 portfolio can generate the kind of returns investors have experienced in the past.

We believe investors should be looking to credit as a way of adding resilience to portfolios. Government bond yields have been falling for decades but crashed lower again this year as investors have flocked to “safe haven” assets. At present only 17% of global government bonds have a yield above 1%3. we believe that Credit investments can provide much-needed yield in this environment. In addition, we view that there are significant opportunities to add value from active management, particularly when markets are volatile. There is an inbuilt resilience to credit because corporate bonds are legal obligations that mature at a known value at a known time. Because of this, even if prices are impacted in the short term by market events, with sound credit analysis there will be a rebound in performance as securities “pull to par.” While the drawdown in our own credit funds was particularly violent in March this year, we have seen a bounce back as market conditions have normalized. There was no permanent impairment of capital in our portfolios, and over a medium to long-term horizon,

APPENDIX

Credit investments have historically provided investors with reasonable returns, with on average one eighth of the volatility of equity investments.

Credit volatility during the 2020 liquidity crisis was extraordinary – greater than that witnessed during the Global Financial Crisis of 2007-08.

This tremendous volatility has set the stage for the strong rebound in credit spreads we have seen in the months since.