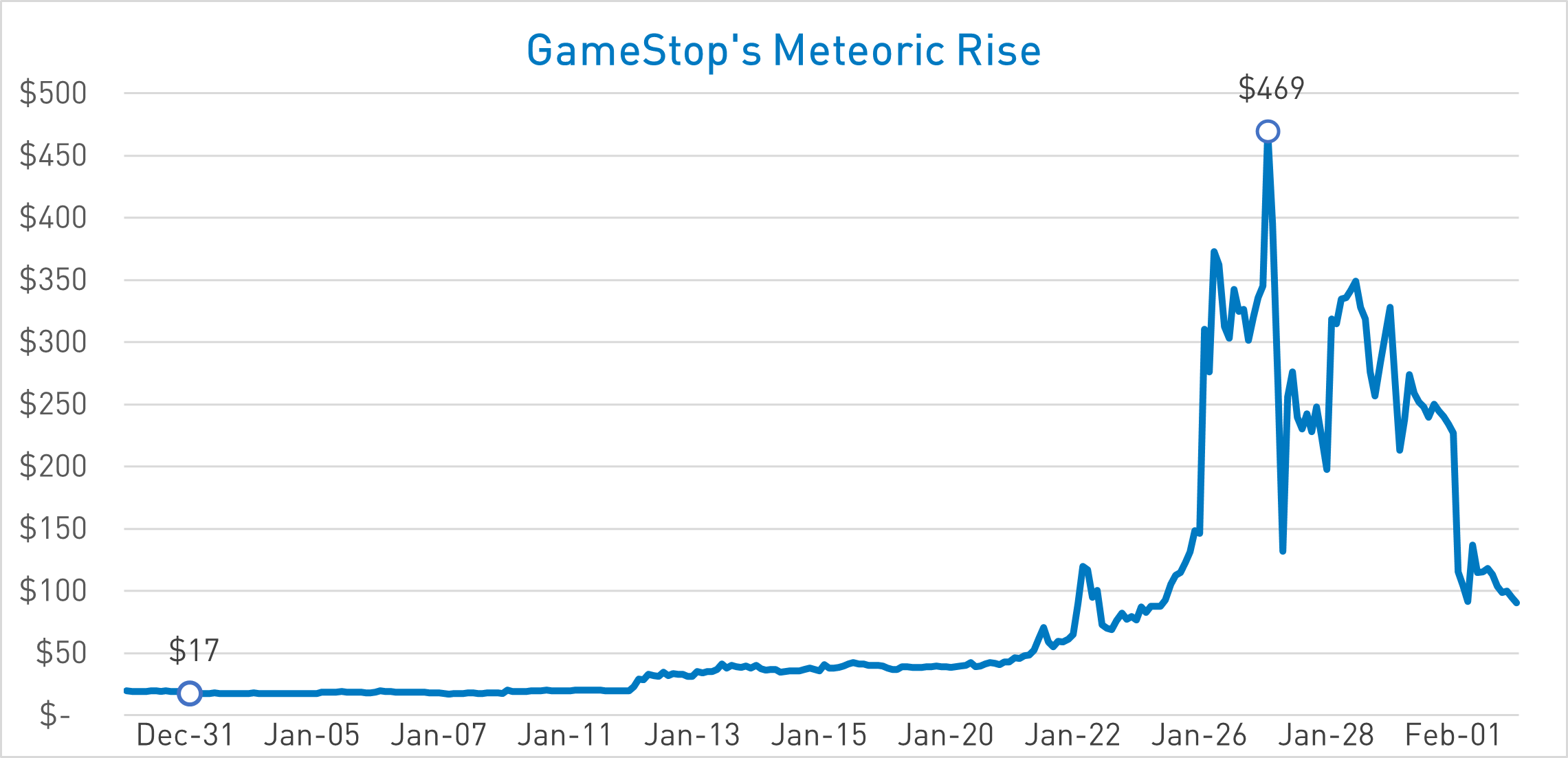

During January we witnessed the first social media driven short squeeze. We entered 2021 expecting the near-term themes driving markets to be the Biden Presidency, COVID-19, and the prospects for economic re-opening. We did not expect headlines to be dominated by topics such as Subreddits, Diamond Hands, and Roaring Kitties. By now, most people would have read the details of this story. To summarize, retail investors have mobilized their capital via Reddit to put pressure on highly shorted stocks mainly held by large hedge funds, creating the first social media driven short squeeze we are aware of. The focal point has been on GameStop (GME), a common short position among many hedge funds, which has now seen its stock price balloon from the low of $2.80 in April 2020 to a high of $347.51 reached on January 27th. This increase in price stands in stark contrast to the significant headwinds facing the business. Retail investors have also targeted other heavily shorted stocks with the aim of causing pain for certain hedge funds, as evidenced by the near uniform outperformance of stocks with high short interests.

How this all plays out for equity holders is yet to be seen but at the time of writing, we already began to see pullbacks in stocks such as GameStop. Having deviated so far from fundamental value, selling pressure and profit-taking could wreak havoc on those retail investors who chose to hold their positions. In a rare moment of agreement, we saw Ted Cruz support a tweet from Alexandria Ocasio-Cortez, responding to Robinhood’s shutdown of trading in highly volatile stocks. While the two politicians may agree in their defense of retail investor’s rights to trade, as these high-flying stocks return to earth, and certain retail investors face serious losses, we could see their opinions diverge. We continue to monitor the ramifications for how the market, regulators, and Washington handle the fallout.

Corporate bonds markets have been calm owing to some important structural differences between bonds and equities. While the VIX index shot up 63% from January 26th to the 27th, both investment grade and high yield spreads have remained relatively calm, moving +2 bps and +10 bps, respectively, for the same period. This calm can be explained by the nature of corporate bond markets versus equities. Corporate bonds continue to trade over the counter, meaning large institutions are still the dominant players in the space. In contrast, access to equity markets has never been easier with zero-fee trading and app-based brokerage platforms (such as Robinhood, which has been the platform of choice for GameStop investors). More importantly, the average equity investor can now easily access tools to magnify their capital via fractional shares, options, and leverage. The dynamics of ease of access and leverage of investment capital have made these short squeezes possible. But for corporate bonds, these outlets do not exist for the retail investor. The closest vehicle through which retail investors can gain access to corporate bonds is via ETFs. However, structural elements of ETFs (specifically the ability to reconstitute the portfolios of bonds that make up the vehicles and issue/redeem units) make it near impossible for even large amounts of mobilized capital to push bond ETF prices off market clearing levels. Buying individual bonds is even more difficult, usually requiring large amounts of capital per trade. While we believe in the long-term democratization of bond markets, we do not believe this is a short-term catalyst.

Even though the corporate bond market at large has seen minimal impact, individual companies that have both debt outstanding and were targeted for short squeezes, did see some impact in bond spreads. One issuer we have been following is AMC, the Kansas based movie theatre company, whose stock was targeted by investors. The stock’s exponential jump in price from $2.01 on January 4th to a high of $19.90 on January 27th was mirrored in appreciation of the company’s corporate debt (AMC 5-year bonds moved from a low $70 price to above par). However, this was not a direct result from the short squeeze on the stock. Instead, this was a second order impact as AMC raised additional equity capital in late January through a major investor group, which chose to convert its debt holdings into equity despite elevated prices. On the back of this news, AMC’s existing bonds rallied as bond holders now benefitted from a larger equity cushion in the company’s capital structure.

Despite the minimal impact to broad credit, we are closely monitoring how this trend impacts different asset classes. At the time of writing, the impact of social media mobilized capital was moving beyond select, highly shorted stocks to other asset classes. Silver has become a point of interest, hitting an 8 year high on increased volumes. We recognize there are other asset classes that could see the impact from a targeted buying campaign, especially in areas of the market dominated by retail volumes. Special Purpose Acquisition Corporations (SPACs) are a keen area of focus for us as retail flows tend to dominate SPAC trading around acquisition. While we continue to participate in the pre-acquisition portion of these investments (a period where we can construct discounted securities with limited downside), we are also conscious that if sentiment pushes more and more investors to participate in SPACs earlier in the process, we could see valuations limit the number of deals we would participate in.

Over the long-term horizon, asset managers such as ourselves are recognizing the impact that social media platforms can have on market prices. This includes the growing influence of direct retail investment over the more traditional impact felt through mutual fund and ETF investment flows. The events in the stock market over the last month only reinforce our need to evaluate non-traditional sources of market movements, including the likes of Reddit posts. Advances in Natural Language Processing could be a key to properly assessing these changes to quantify sentiment around companies being discussed on social media platforms. We also recognize that metrics such as short interest in an issuer’s equity may now be higher on the list of technical drivers for bond spreads versus past periods. Understanding the layers of a company’s capital structure and the interplay between those layers takes on even more paramount importance given what we have seen in the past month. Our experience in this space has served us well but we will continue to assess how current market events may evolve these relationships in the future.